Taxes are payments that you must pay to the government, mainly through your income, capital gains and dividends. Taxes also exist on transactions for specific goods and services, as well as on specific imports from a specific country (which we call tariffs). It exists to provide income to the government which then uses the money to fund public healthcare, education, defence, infrastructure, and other public goods and services.

Tax withholding is the income tax that is taken out of your gross income by your employer that is routed to the ATO. This is part of the pay-as-you-go (PAYG) system implemented by the government to ‘tax at the source’.

Complexity of Tax Compliance

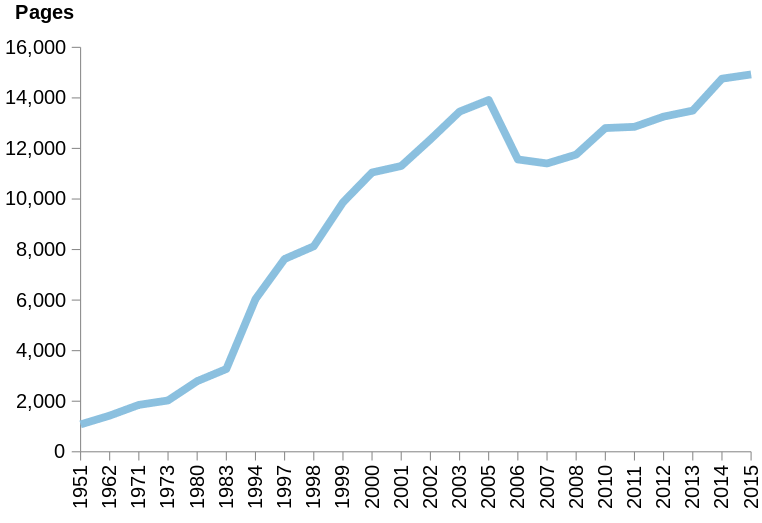

Why is tax so complicated and growing even more so over time? There is a tradeoff between a simple tax system and a tax system that ensures fairness and efficiency. Politics also drive the implementation of special tax policies. Even with 1080 pages of tax law in the 1950s, there are still omissions and revisions required that further increase complexity. Today we have 10000+:

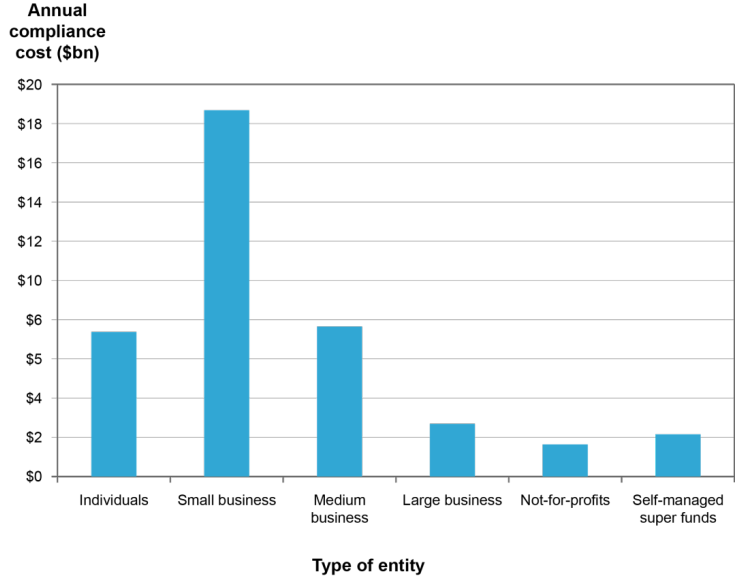

With a more complex tax system, it’s necessary for individuals and firms alike to spend a lot more to ensure tax compliance. In 2012, almost 75% of Australian’s relied on a tax agent to lodge their tax return.

Tax Evasion & Tax Avoidance

Tax evasion or tax fraud is the illegal act of lying about your income or claiming an unpermitted tax deduction with the intention of reducing your tax. An easy way to accidentally commit tax fraud is by using the same capital asset, such as a car or computer, for personal and business use, or by not reporting cash payments you receive from others. Clear record-keeping helps to avoid such accidents.

Tax avoidance is strategically minimising the amount of tax you pay, within legality. It mostly does not involve deception or dishonesty like in tax evasion.

Tax Efficiency

A process is considered tax-efficient if it achieves the minimum tax paid out of other alternative processes while achieving the same outcome. In investing, you should structure your investments to pay the least amount of taxes possible.

Usually, index ETFs are considered more tax-efficient compared to managed mutual funds and LICs due to low turnover (how quickly securities are bought or sold), resulting in fewer realised capital gains being taxed.

ETF Tax

As an ETF investor, pay attention to the following:

- You need to pay tax on 2 things: your distributions (dividends) and capital gains.

- The distributions consist of cash and non-cash components. The ETF issuer sends you a document outlining the distributions’ components (cash, franking credits, foreign credits, etc.)

- You’re receiving the full benefits of franking credits.

- 50% capital gains tax discount on investments held for over 12 months.

- Withheld foreign income, if the ETF invests in overseas companies.

- If you buy US-domiciled ETFs, 30% of the income is withheld on distributions. Some of this is reclaimable by completing a W-8BEN form.