Fundamentally, money is a:

-

Medium of exchange — an asset that makes trading efficient by eliminating the inefficiencies of bartering, a form of trading where two parties exchange goods and relies on mutual desire of the others’ goods, called a double coincidence of wants.

Eg. in bartering, you might trade a video game for someone’s book, but they must be someone who wants that video game for them to agree to that exchange.

- Commodity currencies — money in the form of assets which have intrinsic value, such as precious metals.

- Fiat money — money in the form of something that has no/very little intrinsic value, such as a cash note.

-

Unit of account — the value of everything is measured in terms of the same standard, a dollar, in the same way that all lengths are quantifiable with the standard unit, the meter.

-

Store of value — money can be accumulated and be used to acquire things in the future. People collectively trust in the value of holding money over time.

Money is not the only store of value. You could store your value in the form of other assets like a house or shares. Money, being the medium of exchange, has the advantage of being perfectly liquid meaning that you can directly use it to purchase something. You can’t use a house to purchase something, at least not directly.

Australia’s physical currency is produced by the RBA and Royal Australian Mint.

Money Measures

In modern economies, money takes the form of physical currency (notes/coins) and private bank deposits.

Some standard measures of money used by Australia. Some figures as of 2022, sourced from the RBA

| Currency | Description | value |

|---|---|---|

| Currency | Physical notes and coins produced by the public sector. | ~74 billion AUD |

| M1 | Currency, plus private bank deposits. | ~357 billion AUD |

| M3 | M1, plus any deposits made to non-banks. | ~2086 billion AUD |

| Broad money | M3, plus all the money borrowed from private sector. | ~2096 billion AUD |

Money Supply

Money supply is the amount of money circulating in the economy. It can be a measure of currency, M1, or other standard measures of money.

Money Demand

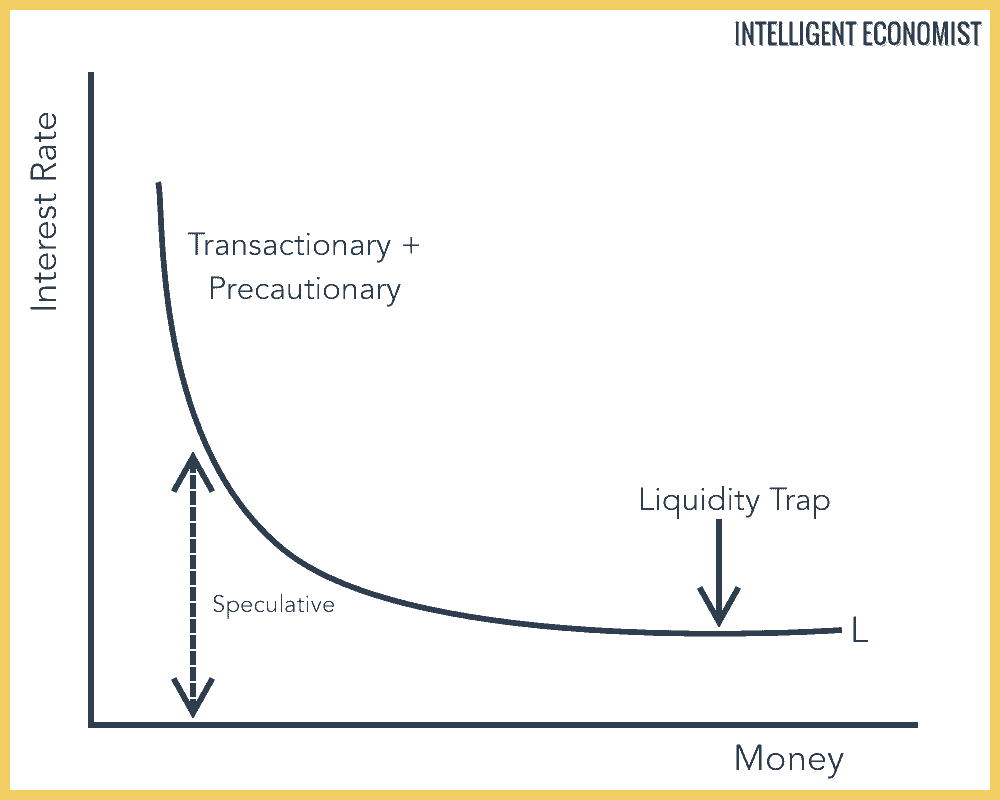

Money demand is basically how much money we, in aggregate, would like to hold in our bank accounts (as opposed to lower liquidity assets): where is the aggregate price level and is the liquidity preference function, which is a function of real GDP and interest rate. A decrease in the opportunity cost of holding money will shift the money demand curve up.

The liquidity preference function looks like this:

Sourced from Intelligent Economist.

Sourced from Intelligent Economist.