The exchange rate is the pricing of one country’s currency relative to other currencies.

Bilateral nominal exchange rate is rate at which two countries can exchange their currencies. In Australia, we express the exchange rate towards every other foreign currency like . A higher means that \1 \text{ AUD}$ buys more of that foreign currency.

Bilateral real exchange rate measures the price of domestic goods & services relative to the price of the same foreign goods & services. It’s useful to use a price index like the CPI to compare the prices of goods and services broadly in different economies. The real exchange rate, , gives some measure of international competitiveness. If a country’s goods & services become less expensive, that is becomes lower, then it’ll tend to have higher net exports.

Models of Nominal Exchange Rate

Law of One Price

The Law of One Price asserts that a tradable good should be priced the same irrespective of where it’s coming from (after the application of taxes and transportation costs). If this is not the case (which it indeed isn’t in practice), people can exploit the price difference and make a profit.

Purchasing Power Parity

The purchasing power parity is an idea that extends the Law of One Price to a general basket of goods and services instead of just one good or service. It asserts that the exchange rate between two currencies will change to reflect the price levels within the two countries, ie. that

A rise in prices, or higher inflation, in the home country will reduce , making it so that the home currency purchases less of the foreign currency.

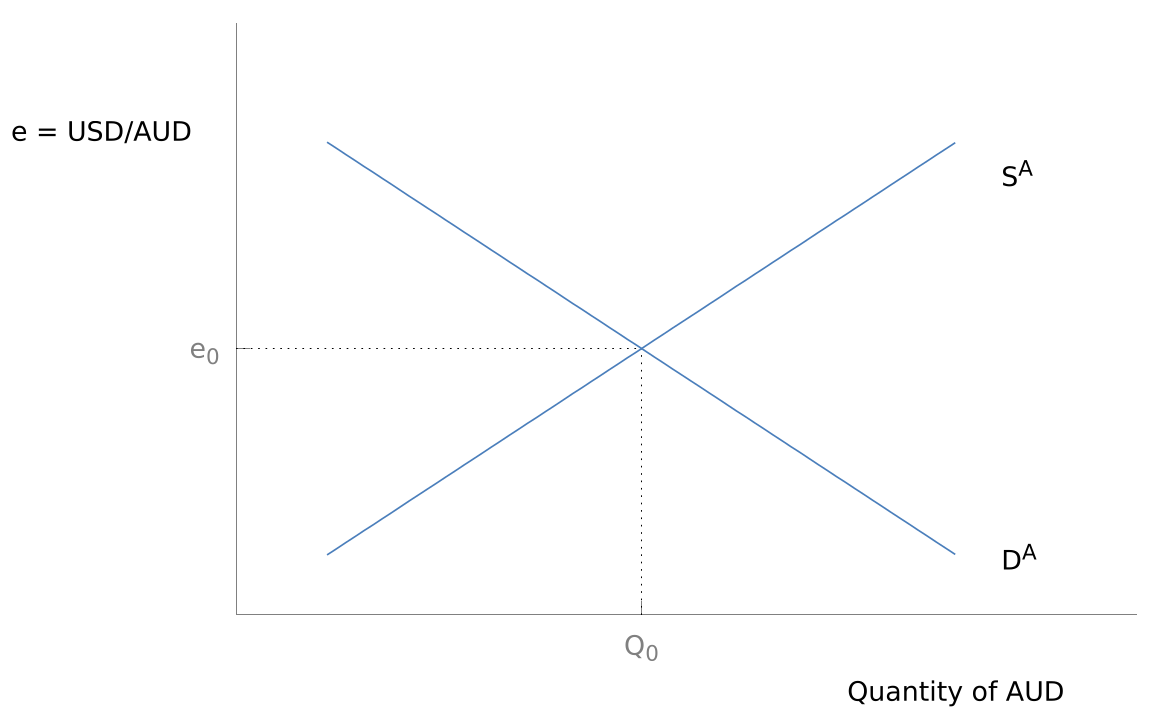

Foreign Exchange Market

The supply and demand model is useful for seeing how the exchange rate is set between two currencies. In the AUD/USD exchange market, a greater preference for US goods by Australians would push the supply curve to the right, and likeiwse, a greater preference for Australian goods by US residents would push the demand for AUD to the right.

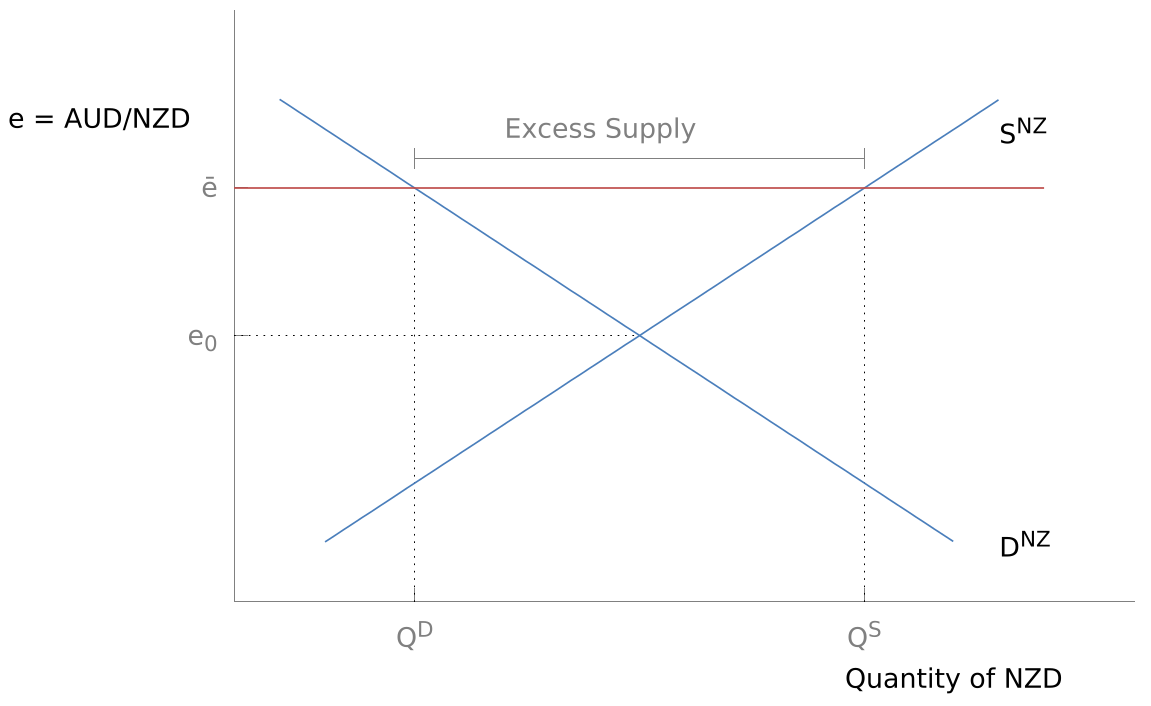

Fixed Exchange Rates

It’s possible to sustain an overvalued fixed exchange rate for the home country’s currrency if the central bank purchases the excess supply of the home country’s currency

If market participants doubt the long-term sustainability of an fixed exchange rate, they might sell their holdings of the currency on the inflated value in aggregate, launching what’s called a speculative attack.

Effect of Monetary Policy

When monetary policy tightens in a country, increasing the interest rates will tend to reduce the country’s demand for foreign goods & services and increase foreign demand for domestic goods & services, causing the home country’s currency to appreciate. A loosening of monetary policy tends to depreciate the country’s currency.