Stocks represent pieces of official ownership, called ‘ownership equity’, of a business. The entitle the owner to a proportionate amount of the business’ assets and profits. They are a type of security and are traded in the stock market.

- Your ownership is quantifiable as: .

- Stocks are often categorised under industry sectors, for example: tech stocks, energy stocks, etc., and locations, for example: US stocks, Australian stocks, etc.

Shares are the smallest denomination of a company’s stock. They’re units of stocks. Companies will usually have millions or billions of total shares, called ‘outstanding shares’. You can also buy fractions of a single share, called partial shares.

- Owning shares in a company makes you a shareholder of that company. Shareholders get to vote and sometimes get a portion of the business’ profits, called Dividends. If the company becomes more profitable between the time you bought the shares and the time you sell it, you’ll have capital gains on the shares.

- Your ownership gives you voting power in meetings and elections within the company. Generally, 1 share held gives you 1 vote, however this is set by the company, who can also split off shares into different classes where one class’ shares have a greater weighting than another in terms of voting power.

Why do companies sell stocks?

When companies choose to list themselves on a stock exchange like the Nasdaq through an initial public offering, they’re provided with liquidity and a means to acquire money for capital investment. The tradeoff is that they’re subject to greater expenses and tighter regulation.

Equity financing: to grow your company requires you to have access to a huge amount of capital, i.e. money to invest in your ventures and operations. When a company can attract investors by listing themselves on the stock market, they’ll be able to lease an office, hire more people, get more equipment, pursue more marketing efforts, etc. Acquiring money by letting investors become partial owners of your business is called equity financing.

Debt financing: an alternative way for companies to raise capital is to sell bonds. For most startups, they simply don’t have the assets to really sustainably meet debt payments, so equity financing is the preferred capital-raising method, where they don’t have to pay as much as they grow.

Many companies will opt to sell both stocks and bonds. The act of selling shares is called equity financing and the act of selling bonds is called debt financing.

Companies can also acquire funding from venture capital firms or angel investors.

Why Are Stocks Called ‘Stocks’

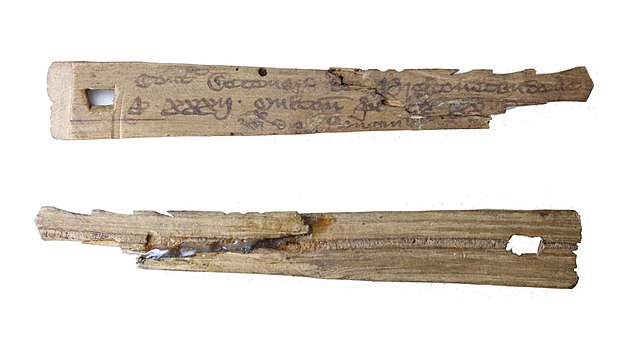

In medieval Europe, people recorded debts by etching marks on tally sticks and splitting them. When split, the stick would have a very unique pattern of splitting that was hard to tamper with. The longer part was called the ‘stock’, given to the lender, the shorter part was called the ‘foil’, given to the borrower. These sticks were considered legal proofs of transactions for hundreds of years until the 1800s.

Stock, Shares and Equities

In everyday conversation, all 3 are the same. Formally, however, there are differences:

- Stock: a representation of ownership in a company.

- Share: the smallest denomination of company stock.

- Equity: generally, it’s the ownership of assets that have liabilities associated with them. For example, a home equity is the difference between the market value and the remaining balance owed on a mortage.

The stock market, share market and equity market all refer to the same thing.

Why do stocks have any value?

If a stock doesn’t pay dividends, then why is the stock worth anything?

- A share has value based on the expectation of future dividends or a future acquisition, both of which depend on a company’s profitability. When someone buys your shares, they’re paying for this expectation.

- Holding shares also means you own a proportional fraction of all the capital the company has (real estate, computers, materials, reputation, intellectual property, their investments, and so on). In the event of liquidation, you have a claim on the value of some of this capital.

- A company that reinvests their profits instead of distributing it to shareholders can compound their growth.

- The ‘right to vote’ within a company may not have much value to you as an investor, but it would matter to employees, customers or business partners.

The above are reasons why stocks have intrinsic value, however the actual stock price is determined by people thinking it has value.

How are stocks bought and sold?

Investors and traders submit orders to buy (bid) or sell (ask) shares at a specific price to a stock broker. When a bid and ask are compatible, then an exchange proceeds. Depending on the market’s liquidity, the matching of bids and asks can happen virtually instantly or may take time or fail to be fulfilled.

The matching of bids and asks was done manually originally but has been superseded by electronic trading systems that minimise inefficiencies and increase speed of transactions.

How are stocks ‘stored’ or ‘owned’?

Companies listed on an exchange maintain a register of shareholders. The book-keeping may be delegated to the brokerage firm you bought the stocks through, who is responsible for recording your ownership of the securities and protecting it from loss of theft.

Alternatively, some companies can issue physical certificates as one way of proof of ownership, but this is hardly ever done anymore in favour of the convenience and reliability of electronic records. For 4 centuries, holding the paper certificate you’re issued was the only way of proving stock ownership.

Common vs. Preferred Shares

Shares are usually either common shares and preferred shares.

- Preferred shareholders get priority over common shareholders when receiving dividends and the assets if the company liquidates.

- Preferred stocks grant the holder no voting rights while common stocks do.

- Preferred stocks are less risky but have lower potential returns.

Common stocks are sometimes further differentiated into different classes of voting power. For example, Class A shares may allow 10 ‘vote units’ while Class B shares may only allow 1 ‘vote unit’.

Restricted vs. Float Shares

Restricted shares are shares you can’t buy or sell without permission from the SEC. They’re issued typically as part of an employee’s compensation. Float shares are shares that can be freely traded by the public.