Fiscal policies are the policies around the usage of government income and expenditure in an effort to positively affect macroeconomic variables like inflation, unemployment rate, etc.

Fiscal policies include things like:

- Tax cuts which are reductions to how much tax you’d pay on your personal income.

- Transfer payments, which are direct payments the government makes to individuals without anything in return. This is usually done to fairly distribute wealth, or to subsidise something (eg. the JobKeeper policy was introduced in the COVID-19 pandemic).

- Subsidising home renovations (eg. solar panel rebate).

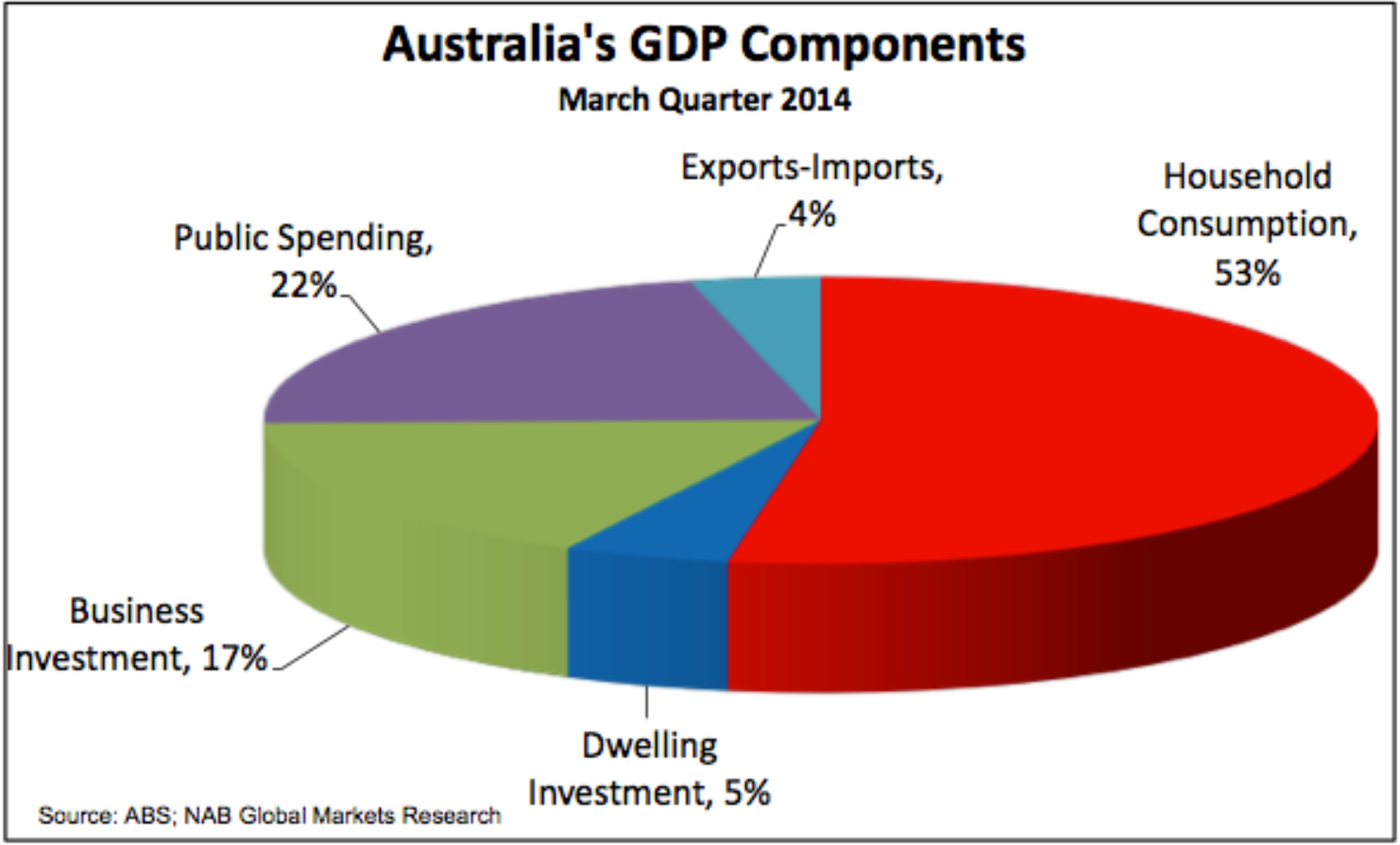

Government expenditure occupies about 20% of a country’s GDP.

3-Sector Economy

Considering a three-sector economy in the income-expenditure model, we’d have .

Suppose we have the tax function: , with being the marginal propensity to tax, or marginal tax rate. At equilibrium GDP, we would have:

Expressed in changes, this would be:

This lets you assess how changing one exogenous variable would change the equilibrium GDP. Notice that with the multiplier , an increase in government spending would cause a rise of which is always larger than \1$ to the real GDP.

Opening the Economy When we open this 3-sector economy to international trade, we’d have . Using the following substitutions, we can derive the equilibrium GDP and its multiplier:

Balanced Budget Multiplier

A surprising result from equation is that you can increase government expenditure and taxes by the same amount but still end up with a positive change in the GDP. The balanced budget multiplier can be determined as:

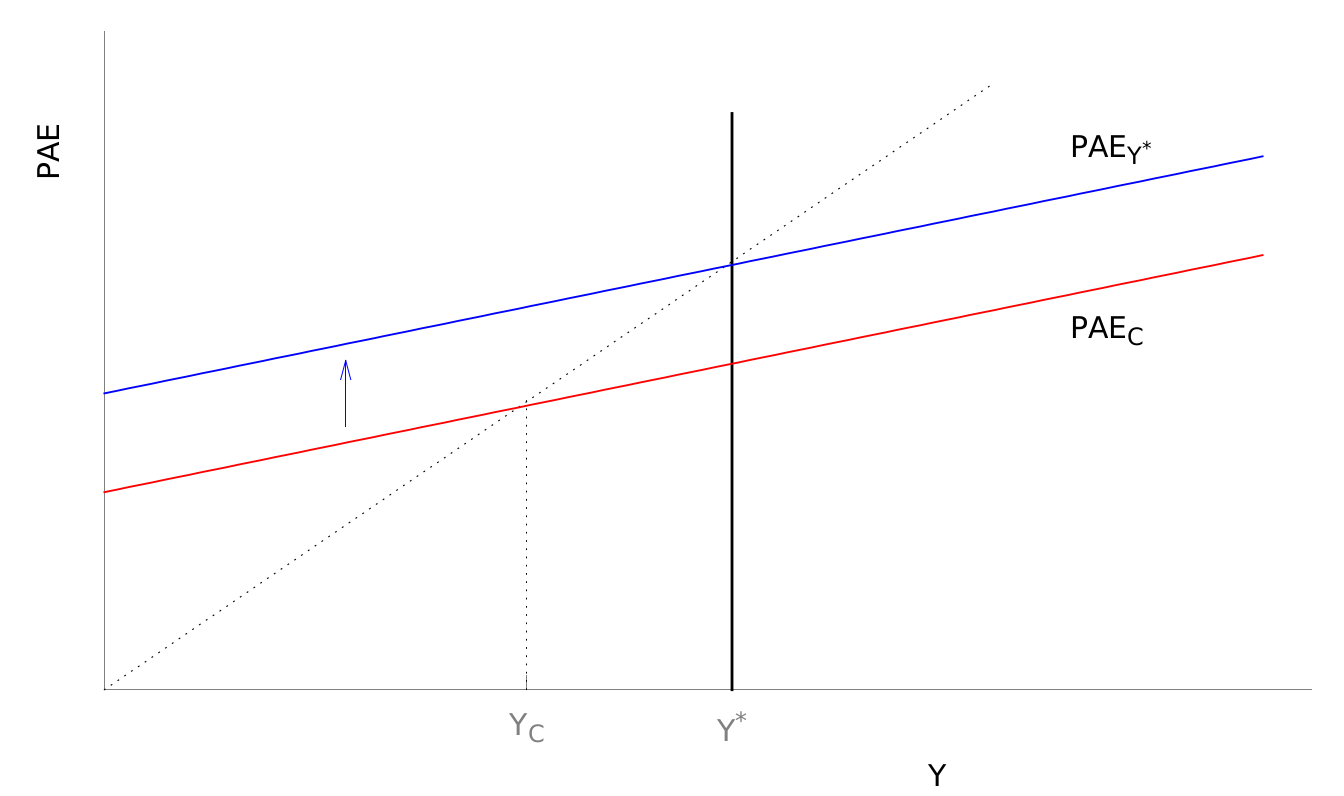

This means that fiscal policies can help with closing contractionary output gap. For instance, you could achieve the following shift in the curve.

This shift is achieved by cutting taxes and/or increasing . Likewise, when faced with undesirably high inflation, governments can implement a contractionary fiscal policy that closes expansionary output gaps. Importantly, fiscal policies have a large effect on government debt. Expansionary fiscal policies reduce government budget and contractionary fiscal policies increase government budget.

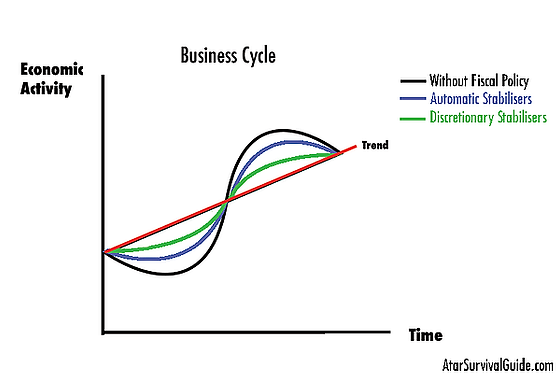

Automatic Fiscal Stabiliser

An automatic fiscal stabiliser is a tax or government transfer payments system that helps dampen business cycle fluctuations. Eg. marginal tax rate systems and welfare payments are examples of automatic stabilisers.

Consider the case where all exogenous variables except are constant in a closed 3-sector economy, so: . Here, the amplitude of each business cycle can be controlled by tweaking the marginal tax rate and therefore the multiplier.

Discretionary fiscal policies are ones undertaken explicitly by the government to counter fluctuations in the business cycle.