Index funds are a subclass of mutual funds that are passively managed instead of actively managed. They track a specific market index.

Index funds, and index investing in general, were ‘invented’ by Jack Bogle in the 1970s, who founded Vanguard. He essentially got sick of mutual funds charging people so much for active management. He’s credited with being the person who has helped investors create more wealth than anyone else on the planet. You could individually buy each company listed in an index, however the brokerage fees would be massive. An investment company like Vanguard optimises this and provides the lowest possible fees.

The expenses associated with actively managed mutual funds (those that have people monitoring investment performance) tend to be considerably higher than passively managed mutual funds (ie. index funds). Roughly, actively managed mutual funds often charge of your account balance per year while index funds charge well below since they do not need to pay for research and analysis.

Investing in an index allows you to say “I don’t know anything about choosing a company, sector, country, or anything else, and I also don’t know how to choose a fund manager capable of choosing them. I accept that I don’t know. But I still need to invest for my future.” (sourced from PassiveInvestingAustralia)

It’s widely recommended that most investors should just make monthly investments (dollar-cost averaging) into a low-cost index fund.

“Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results (after fees and expenses) delivered by the great majority of investment professionals” — Warren Buffett, 1996 Letter to Shareholders.

Historically, the only time investing in index funds has not worked has been when people cave into their emotions and deviate from their commitment to invest a regular sum into an index fund and attempt to beat the market on their own. Just stay the course.

Success of Index Investing

- Index funds have famously outperformed the vast majority of actively managed funds over the long term, after-fee.

- It not only offers reliably superior performance over longer time horizons, it also minimises the amount of time you spend on investing (since you don’t have to research stocks) so you can spend time doing other meaningful things. For high earners, this time saved is non-trivial, and may have nullified any market outperformance you did achieve.

- Index investing is more easily done without emotion.

“Fama and French (2010) reported results of a separate 22-year study suggesting that it is extremely difficult for an actively managed investment fund to outperform its benchmark regularly.” — Vanguard, The Case for Indexing (Australia)

The ability to earn money on delayed tax payments (and earnings on those earnings, and so on) is one of the biggest advantages of capital growth over income-focused investments… This triggering of capital gains for all investors does not occur with ETFs due to the unique tax structure of ETFs. Instead, you defer these capital gains until you sell your ETF shares*.

What If We’re At a Peak?

Jack Bogle recommends to always commit to investing in an index fund, even if they’re priced at all-time highs and you’re convinced that they’re overvalued.

“Never think you know more than the market does.” — Jack Bogle.

Picking an Index Fund

In Australia, there are hundreds/thousands of ETFs to potentially choose from and different ETF providers such as Vanguard, BetaShares and iShares (by BlackRock). ETFs also go by different ‘themes’, such as those concentrating on international markets, US markets, domestic markets, energy sector, tech sector, etc.

Considerations:

- Expense ratio — the percentage of your total assets value taken by the fund as an operation/management fee. Even expense ratios of 1% will have an unintuitively massive impact on your long-term balance.

- Liquidity.

- ETF size and trading volume are not necessarily indicative of liquidity in that same way that they are for individual shares.

- Currency hedging.

- Exposure to markets you’re interested in.

US Index Funds

- VTI — Vanguard Total Stock Market Index Fund ETF, which tracks the CRSP US Total Market Index.

- 0.03% expense ratio, which is about as low as it can possibly go.

- VTS — Vanguard U.S. Total Market Shares Index ETF AUD, which is pretty much the same as VTI but has a different name on the ASX.

- 0.03% expense ratio.

- Since VTS is a cross-listing of the US-domiciled VTI, automatic dividend reinvestment is unavailable, and has a slightly more annoying tax process.

- IVV — iShares Core S&P 500 ETF, which tracks the S&P 500.

- 0.03% expense ratio.

- Australian-domiciled, so no tax process.

Australian Index Funds

It’s argued that the Australian market is too concentrated and constitutes only ~2% of the world’s markets. The US market constitutes around ~40% of the world’s markets. Australian index funds, however, let you exploit franking credits.

- VAS — Vanguard Australian Shares Index ETF, which tracks S&P/ASX 300.

- 0.10% expense ratio.

- The ASX 300 consists of the top 300 companies by market capitalisation. The list of companies is ‘flushed’/rebalanced biannually by default.

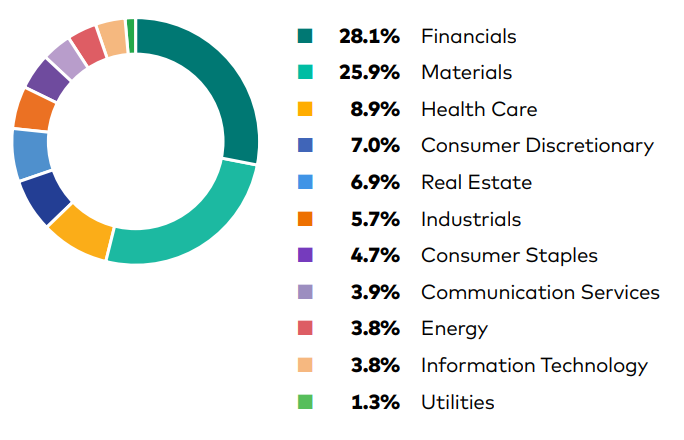

- Banks represent a large chunk of the ETFs value. Chart sourced from Vanguard

- The holdings are weighted by market capitalisation, meaning that the larger companies constitute a larger part of your portfolio.

- Has one of the highest trading volumes, therefore high liquidity.

- A200 — BetaShares Australia 200 ETF, which is basically VAS but it only tracks the top 200 companies of the ASX and has a lower management fee.

- 0.07% expense ratio.

- VAP — Vanguard Australian Property Securities Index ETF, which tracks the S&P/ASX200 A-REIT.

International & Emerging Markets

- VEU — Vanguard All-World ex-US Shares Index ETF AUD

- 0.07% expense ratio.

- VGS — Vanguard MSCI Index International Shares ETF

- 0.18% expense ratio.

- Has automated dividend reinvestments.

- VDHG — Vanguard Diversified High Growth Index ETF

- 0.27% expense ratio.

- This is all-in-one. You cannot customise it.

- Very frequently recommended to beginner investors. It does not require manual rebalancing.

- VGE — Vanguard FTSE Emerging Markets Shares ETF.

- 0.48% expense ratio.

- VGS — Vanguard MSCI Index International Shares ETF, which tracks the MSCI world ex-Australia Index

- 0.18% expense ratio.

- VGAD — Vanguard MSCI Index International Shares ETF (AUD-Hedged), which tracks the MSCI world ex-Australia Index.

- Pretty much the same as VGS, but higher expense ratio due to the AUD hedging.

- 0.21% expense ratio.

- VAE — Vanguard FTSE Asia ex Japan Shares Index ETF

- 0.40% expense ratio.

- IOO — iShares Global 100

- 0.40% expense ratio.

- Like VGS, but concentrates on 100 companies instead of 1500.

- IAA — iShares Asia 50

- 0.50% expense ratio.

- IVE — iShares MSCI EAFE ETF for Europe, Aus, and Asia exposure.

- 0.32% expense ratio.

- IWLD — iShares Core MSCI World ex-Australia ESG Leaders ETF

- 0.09% expense ratio.

Interesting ETFs

- CRYP — BetaShares Crypto Innovators ETF

- HACK — BetaShares Global Cybersecurity ETF

- ESPO — VanEck Video Gaming and eSports ETF AUD

- ASIA — BetaShares Asian Technology Tigers ETF

- SKYY — First Trust Cloud Computing ETF

- IGV — iShares Expanded Tech-Software Sector ETF

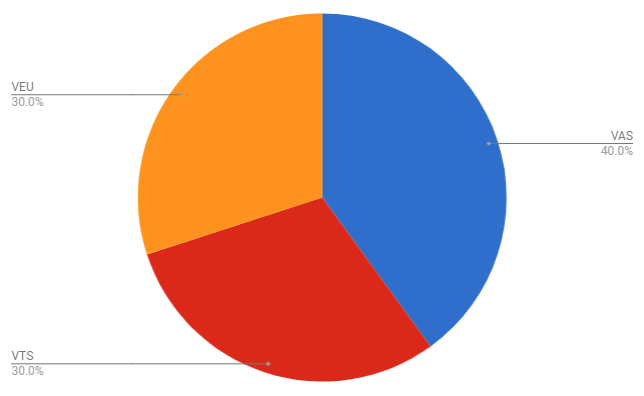

Aussie Firebug Portfolio

- VAS (or A200) for exploiting franking credits.

- VTS for US market exposure, strong returns, and ridiculously low fees.

- VEU for exposure to the largest companies in the rest of the world. Altogether, this portfolio gives you a tiny slice of the largest companies on Earth.