An investment is the purchase of an asset or commodity with the expectation of it producing income for you or appreciating in value. Investing is the set of theory and practices around making smart investments that aid you in meeting your financial goals.

- Understand the power of compounding. Start early and invest regularly.

- Understand diversification.

- Only invest in what you understand.

- Would you want to be an owner of that business?

The main difference between a trader and an investor is how long they hold the asset. Traders focus on capitalising on short-term trends.

Essentials

-

Real Estate TODO

-

Mortgages TODO

-

Conveyancing TODO

-

Building inspection TODO

-

Rent vs. Buy TODO

-

Body Corporate TODO

-

Buying a Home TODO

-

Selling a Home TODO

-

House Hunting TODO

-

Landlording TODO

-

Online Brokers TODO

-

Liquidity TODO

-

Stock Research TODO

-

Specialists TODO

-

Market Maker TODO

-

Bid-Ask Spread TODO

-

REITs TODO

-

LICs TODO

-

ASX TODO

-

CHESS TODO

-

Currency Risk TODO

-

Franking Credits TODO

-

What is microinvesting? E.g. microinvesting apps include RAIZ, Spaceship, etc. TODO

-

FIRE TODO

-

Tax TODO

-

W-8BEN TODO

-

Cryptocurrency

-

Cryptocurrency Exchanges (Coinbase and Binance, for example) TODO

-

Decentralised Finance

-

Short squeeze

-

NFTs

Stock Market

Investing Strategies

- Go 98% ETFs or index funds and 2% individual stocks. This gets you into the habit of researching stocks.

- Avoid all emotional decision-making.

“You don’t make money when you buy and you don’t make money when you sell. You make money when you wait.” — Charlie Munger.

Bond Market

Stocks vs. Bonds

In general: bonds are lower risk but have lower returns than stocks. When you’re young and don’t have strict target dates for financial goals, just go for stocks and allocate a greater percentage of your portfolio to bonds when you require more certainty about your investment returns.

Portfolios

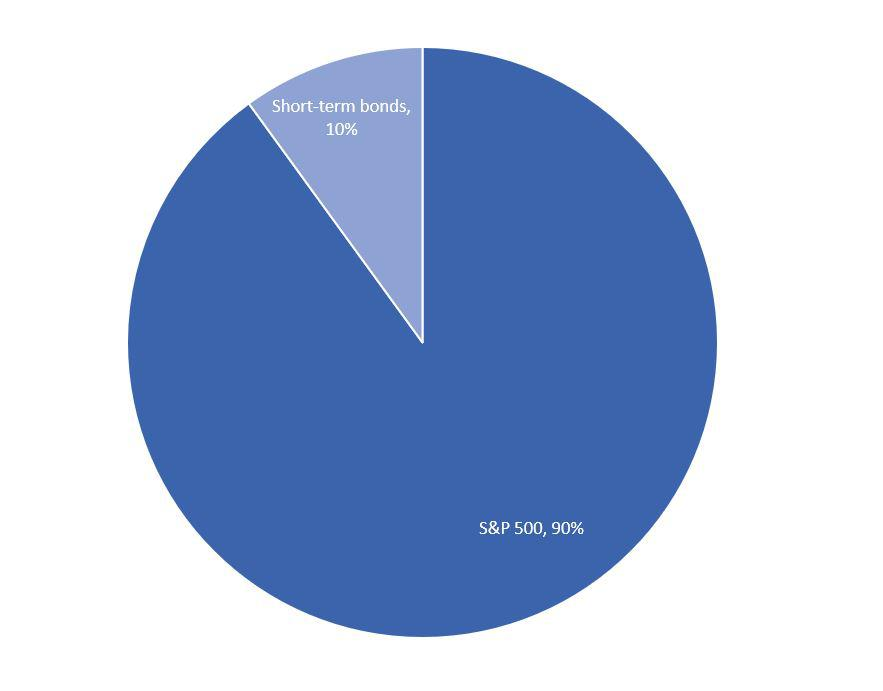

- Warren Buffett’s example portfolio for his wife:

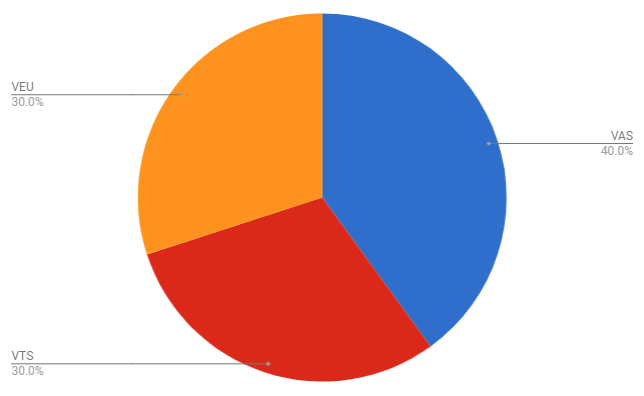

- Aussie Firebug portfolio:

- Having a 100% VDHG portfolio is decent for beginning investors. You can combine VAS, VGS, VTS, etc. to achieve a lower expense ratio but it’ll require occasional manual rebalancing.

- 50/50 split across Australian and international ETFs.